Estate Planning in Decline: New Data Shows a Concerning Trend

Posted on: June 5, 2025

Helen Solomon

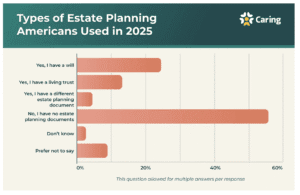

According to Caring.com’s 2025 Wills Survey, the number of Americans with a Will continues to decline. In 2025, only 24% of adults reported having a Will—down from 33% in 2022. Even more concerning is the fact that Americans with children under 18 make up the largest group without any estate planning documents in place.

Despite this decline, those who do have a will are increasingly proactive, with most updates made in the last five years. Many cite life events like family expansion or a change in assets as reasons for revisiting their estate plan. Additionally, the long shadow of the COVID-19 pandemic continues to influence behavior—five years later, its impact is still prompting many to take estate planning seriously.

And yet, more than 50% of Americans still don’t have a Will at all. This reflects a troubling gap between what people believe is important and the steps they actually take to protect their families and their legacy.

Understanding the Basics of Estate Planning

Estate planning is the process of outlining exactly how you want your money, property, and personal matters handled if you become incapacitated or pass away. It also includes medical care decisions and final arrangements. There are four primary documents that form the foundation of most estate plans:

Will – A Will allows you to designate how your assets, debts, and personal property should be distributed after your death. However, Wills must generally go through Probate in California—a court-supervised process that can be lengthy and public. Once a Probate case is opened, the contents of your Will, as well as the property you own, become public record. For individuals seeking to avoid Probate as well as achieve privacy and efficiency, a living trust is by far the preferred tool.

Living Trust – Unlike a Will, a Living Trust takes effect immediately and can manage your assets both during your lifetime and after your death. While slightly more costly to establish, a living trust avoids Probate, keeps your affairs private, and provides a plan for asset management in the event of disability or incapacity.

Advance Health Care Directive – This document allows you to clearly state your medical and end-of-life care preferences in case you become unable to communicate them yourself. It gives peace of mind to both you and your loved ones, knowing your wishes will be followed.

Durable Power of Attorney (Financial) – This legal tool designates a trusted individual (or individuals) to manage your financial affairs if you are incapacitated. You can define the scope of authority granted—everything from paying bills to managing investments or even handling online accounts.

At Botti & Morison, we are here to guide you through the process with compassion and clarity. Whether you’re just getting started or already have an estate plan that may need updating, we’re ready to help ensure it aligns with your current needs.

Contact us today at 877-585-1885 to schedule your free consultation and take the first step toward peace of mind for you and your loved ones.

Thanks for reading.

Christopher E. Botti, Esq. Board-Certified Specialist in Estate Planning, Trust, and Probate Law.

This blog is for informational purposes only and does not constitute legal advice. Every situation is unique, and you should consult with a qualified attorney for advice regarding your specific circumstances.